In economics, decisions are often made in unpredictable environments. The concepts of risk and uncertainty play crucial roles in determining how individuals, firms, and governments allocate resources and design policies. Recognizing the difference between the two is essential for understanding decision-making processes.

- Risk refers to situations where the probabilities of different outcomes are known. For instance, flipping a coin involves a 50% chance of landing heads or tails.

- Uncertainty involves outcomes that are unknown and cannot be assigned probabilities. Examples include the economic consequences of unforeseen events, such as pandemics or natural disasters.

Economic agents respond to these challenges by making choices that balance potential gains with associated risks. Tools like Expected Utility Theory and insurance play a significant role in helping agents make rational decisions and manage their exposure to losses.

Economics of Risk

When making decisions under uncertainty, individuals and firms consider both the likelihood and impact of potential outcomes. This process often involves choosing between alternatives with varying levels of risk and reward. Expected Utility Theory helps agents determine the course of action that offers the highest satisfaction or utility.

Expected Utility Theory in Action

The goal of economic decision-making is to maximize expected utility, rather than simply maximizing returns. The expected utility formula is:

\( E(U) = p_1 U(x_1) + p_2 U(x_2) + \cdots + p_n U(x_n) \)

Where:

- \( p_i \) represents the probability of outcome \( i \).

- \( U(x_i) \) is the utility associated with outcome \( i \).

This formula reflects the fact that individuals weigh potential outcomes based on their preferences and risk tolerance. People may value a small but certain outcome more than a larger but uncertain one.

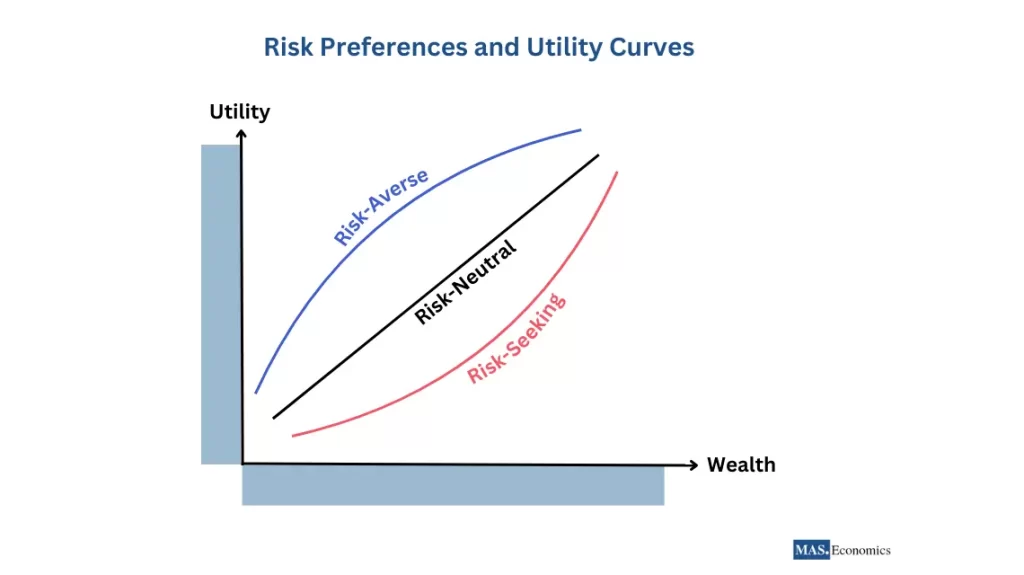

Risk Preferences and Utility Curves

To better illustrate how risk preferences vary among individuals, Figure 1 below shows three types of utility curves, reflecting different attitudes toward risk.

In the graph, the horizontal axis represents wealth, while the vertical axis shows utility, which refers to the satisfaction or benefit an individual gains from wealth. The three curves demonstrate how individuals derive utility differently based on their risk preferences:

Risk-Seeking (Red Curve)

The convex shape of the red curve shows that the marginal utility of wealth increases with higher levels of wealth. Risk-seeking individuals are willing to take on more risk for the chance of gaining greater wealth, often engaging in speculative activities like gambling or high-risk investments. Their preference for risky situations implies that they gain more satisfaction from taking on greater risks, despite the potential for loss.

Risk-Averse (Blue Curve)

This curve is concave, indicating that the marginal utility (additional satisfaction from gaining more wealth) decreases as wealth increases. Risk-averse individuals prefer certainty over risk and are likely to purchase insurance to protect their wealth. The curvature of the utility function shows that they would rather avoid a potential loss, even if it means giving up potentially higher gains.

Risk-Neutral (Black Straight Line)

The linear relationship here reflects the fact that risk-neutral individuals do not care about the risks associated with potential outcomes. They focus purely on the expected return, without adjusting for the possibility of gains or losses. For them, the utility increases at a constant rate as wealth increases, meaning that they are indifferent between a sure outcome and a risky one with the same expected payoff.

These curves help illustrate why individuals adopt different strategies when faced with uncertainty. Risk-averse individuals prefer safer options, risk-neutral individuals focus on maximizing expected returns, and risk-seeking individuals pursue risky opportunities for potentially higher rewards. The understanding of these preferences is key to explaining behaviors like purchasing insurance or investing in speculative markets.

Insurance Economics

Insurance plays a fundamental role in managing risk by transferring potential financial losses from individuals to insurance providers. By paying a premium, policyholders reduce uncertainty and protect themselves from the financial burden of unexpected events.

The Principle of Risk Pooling

Insurance companies operate based on the principle of risk pooling. They collect premiums from many policyholders, spreading the risk across a large group. As only a few individuals experience losses at any given time, the pooled funds allow the insurer to compensate them while remaining solvent.

Real-Life Example: Car Insurance

A driver purchases car insurance by paying an annual premium. If an accident occurs, the insurer covers the repair costs. This system allows the driver to avoid sudden financial burdens, while the insurer, drawing from the pool of premiums, ensures that other policyholders are protected as well.

Risk Aversion and Insurance Choice

The decision to buy insurance is closely related to an individual’s risk tolerance. Risk-averse individuals prefer certainty over risk and are more likely to purchase insurance, even if the premium slightly exceeds the expected value of the potential loss. For these individuals, the peace of mind provided by insurance is worth the cost.

Example: Health Insurance

A person with health insurance pays regular premiums to protect against medical expenses. Although they may not get sick frequently, the insurance ensures they are covered in case of a serious illness or accident, reducing financial stress.

In contrast, risk-neutral individuals might decide to self-insure by setting aside savings to cover future losses. Risk-seeking individuals, on the other hand, may choose not to buy insurance, believing they can manage any financial consequences on their own.

Challenges in Insurance Markets

While insurance offers financial security, it also introduces challenges such as moral hazard and adverse selection, which can distort market outcomes.

Moral Hazard occurs when insured individuals engage in riskier behavior because they know they are covered. For example, a driver with comprehensive car insurance might drive less cautiously, knowing any damages will be compensated.

Adverse Selection arises when high-risk individuals are more likely to buy insurance, raising the insurer’s costs. For instance, people with chronic health conditions are more likely to purchase health insurance, which can drive up premiums for everyone.

Mitigating Moral Hazard and Adverse Selection

Insurers address these issues by using deductibles, co-pays, and risk-based premiums. A deductible requires policyholders to pay part of the cost before insurance coverage kicks in, encouraging responsible behavior. Risk-based premiums align the cost of insurance with the policyholder’s risk level, ensuring fairer pricing.

The Friedman-Savage Hypothesis

The Friedman-Savage Hypothesis offers a nuanced understanding of human behavior under uncertainty. It explains why individuals may switch between risk-averse and risk-seeking behaviors depending on their financial circumstances or potential outcomes.

Understanding the Duality of Risk Preferences

At Lower Wealth Levels

Individuals exhibit risk-averse behavior, seeking stability and purchasing insurance to avoid losses. For instance, a person with a moderate income may buy health insurance to safeguard against medical emergencies.

At Higher Wealth Levels or High-Payoff Situations

These same individuals may engage in risk-seeking behavior, such as buying lottery tickets or investing in speculative ventures. Here, they are willing to take risks for the possibility of significant rewards.

Inflection Points

The hypothesis suggests that there are specific points where individuals switch between risk-averse and risk-seeking behaviors. At moderate wealth levels, they prefer stability, but as wealth increases, they become more inclined to take risks.

The hypothesis suggests that people exhibit these shifts, highlighting how dynamic preferences toward risk affect economic decisions.

Insurance vs. Gambling

While both insurance and gambling involve risk, their objectives are fundamentally different:

- Insurance: Aims to minimize financial uncertainty through risk transfer and pooling. The expected outcome is neutral or slightly negative due to administrative costs, but the peace of mind it provides is valuable.

- Gambling: Involves voluntarily taking on risks with the hope of achieving significant rewards. The expected outcome is typically negative, as most participants lose more than they win over time.

Understanding these differences emphasizes the practical role of insurance in promoting financial stability, while gambling appeals to individuals seeking thrill or profit.

Applications of Risk and Insurance in Economics

Risk and insurance play vital roles in various sectors of the economy:

Financial Markets: Investors diversify their portfolios to spread risk and use derivatives to hedge against uncertainties, such as currency fluctuations or market downturns.

Healthcare: Health insurance protects individuals from the unpredictable costs of medical care, improving access to treatment and reducing financial stress.

Agriculture: Farmers use futures contracts to lock in crop prices, minimizing the risks associated with price volatility and adverse weather conditions.

Conclusion

Managing risk and uncertainty is essential for individuals, businesses, and policymakers. Insurance provides a reliable tool for mitigating financial risks, offering security and stability in uncertain environments. At the same time, decision frameworks like Expected Utility Theory enable economic agents to make rational choices that align with their preferences and risk tolerance.

However, not all uncertainties can be predicted or insured against, requiring agents to adopt adaptive strategies. As insurers continue to refine their practices to address moral hazard and adverse selection, insurance markets will remain a cornerstone of economic resilience.

FAQs:

What is the difference between risk and uncertainty in economics?

Risk involves situations where the probabilities of outcomes are known, such as the odds in a coin flip. Uncertainty refers to outcomes that are unknown and cannot be assigned probabilities, such as the impact of unexpected events like pandemics or natural disasters.

How do individuals make decisions under uncertainty?

Individuals use Expected Utility Theory to weigh the potential outcomes of their decisions, focusing on maximizing their expected utility rather than just returns. Risk-averse individuals prefer safer outcomes while risk-seeking individuals are willing to take greater risks for potentially higher rewards.

What role does insurance play in managing risk?

Insurance helps individuals transfer potential financial losses to insurers by paying a premium. This reduces uncertainty and protects policyholders from unexpected financial burdens, such as medical expenses or property damage.

How does risk aversion influence insurance decisions?

Risk-averse individuals are more likely to purchase insurance because they prefer certainty and are willing to pay a premium for peace of mind. In contrast, risk-neutral individuals may self-insure by saving for potential losses, while risk-seeking individuals may avoid insurance altogether.

What are moral hazards and adverse selection in insurance markets?

Moral hazard occurs when insured individuals engage in riskier behavior because they know they are covered, such as driving less cautiously with comprehensive car insurance. Adverse selection arises when high-risk individuals are more likely to purchase insurance, increasing costs for insurers and potentially driving up premiums for everyone.

How do insurers mitigate moral hazard and adverse selection?

Insurers use tools like deductibles and co-pays to encourage responsible behavior and align premiums with the policyholder’s risk level. Risk-based premiums ensure fair pricing by reflecting the individual’s likelihood of filing claims.

What is the Friedman-Savage Hypothesis, and how does it explain behavior under uncertainty?

The Friedman-Savage Hypothesis suggests that individuals switch between risk-averse and risk-seeking behaviors depending on their wealth levels or potential outcomes. At lower wealth levels, people exhibit risk aversion, while at higher levels or in high-payoff situations, they may take on more risks, such as buying lottery tickets or investing in speculative ventures.

How is insurance different from gambling?

Insurance aims to minimize financial uncertainty by spreading risk through pooling, providing stability and peace of mind to policyholders. Gambling, on the other hand, involves taking risks voluntarily in hopes of achieving significant rewards, though the expected outcome is often negative for participants.

How do insurance and risk management apply to different economic sectors?

In financial markets, investors use diversification and derivatives to manage risk. In healthcare, insurance ensures access to treatment by covering unpredictable medical expenses. In agriculture, futures contracts help farmers hedge against price volatility and weather risks, stabilizing their income.

Thanks for reading! Share this with friends and spread the knowledge if you found it helpful.

Happy learning with MASEconomics