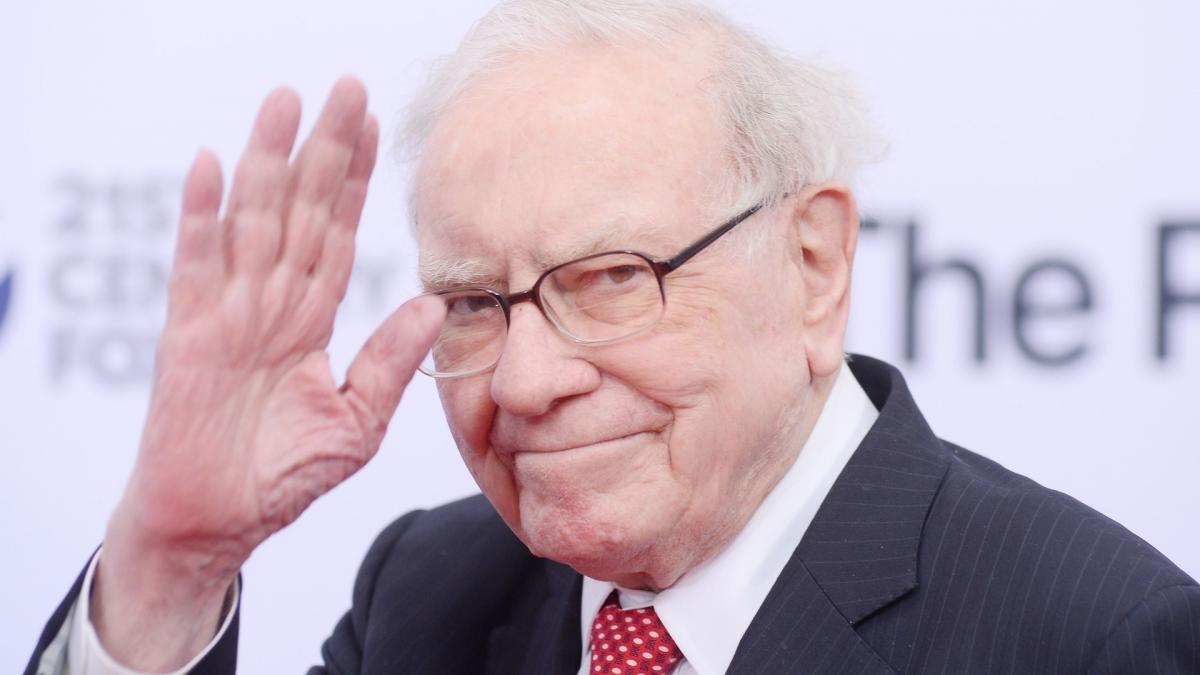

Warren Buffett is greater than only a huge title within the investing world — he’s a legend. With a internet value of round $145 billion, individuals are all ears when he’s talking about enterprise or cash issues.

Test Out: 13 Low cost Cryptocurrencies With the Highest Potential Upside for You

For You: 9 Issues You Should Do To Develop Your Wealth in 2024

From choosing small corporations to not sweating it when your inventory drops, right here’s Buffett’s recommendation for investing $10,000 if you wish to get wealthy.

Trending Now: Suze Orman’s Secret to a Rich Retirement–Have You Made This Cash Transfer?

In the beginning, Buffett recommends getting began early relating to investing to benefit from the facility of compound curiosity. He describes the facility of compound curiosity as constructing just a little snowball and rolling it down a really lengthy hill. Because the snowball rolls down the hill, it collects increasingly snow till it turns into an enormous snowball.

At an annual shareholders’ assembly, when somebody requested him how they may make billions of {dollars}, Buffett mentioned, “The trick is to have a really lengthy hill, which implies both beginning very younger or residing… to be very outdated.”

Learn Subsequent: I’m a Self-Made Millionaire: 5 Shares You Shouldn’t Promote

Buffett recommends investing in small corporations. Massive buyers — like Buffett — and funds have a tendency to put give attention to bigger corporations, which implies small enterprise shares may have much less competitors, permitting somebody with $10,000 to seek out some hidden gems.

However, Buffett mentioned the one strategy to multiply your cash is to purchase into good companies by shopping for items of them — aka shares — at engaging costs.

Buffett mentioned if he was simply getting out of college and had $10,000 to speculate, he’d start by corporations which have names that begin with “A” and proceed down the listing, specializing in smaller corporations to seek out those he needed to spend money on.

“In the event you’re going to do dumb issues as a result of your inventory goes down, then you definately shouldn’t personal inventory in any respect,” mentioned Buffett in an interview with CNBC. Dumb issues, he clarified, are promoting your inventory simply because the worth goes down.

Buffett mentioned that it’s inevitable that your inventory will go down someday, so why fear about it. “The purpose is to purchase one thing you want, at a worth you want, after which maintain it for 20 years,” he mentioned.

Buffett mentioned you shouldn’t have a look at your shares daily. “In the event you purchased a farm or an residence home, you wouldn’t get a quote on it day-after-day or each week or each month,” he mentioned. “So it’s a horrible mistake to think about shares as one thing that bob up and down and that you need to take note of these bobs up and down.”