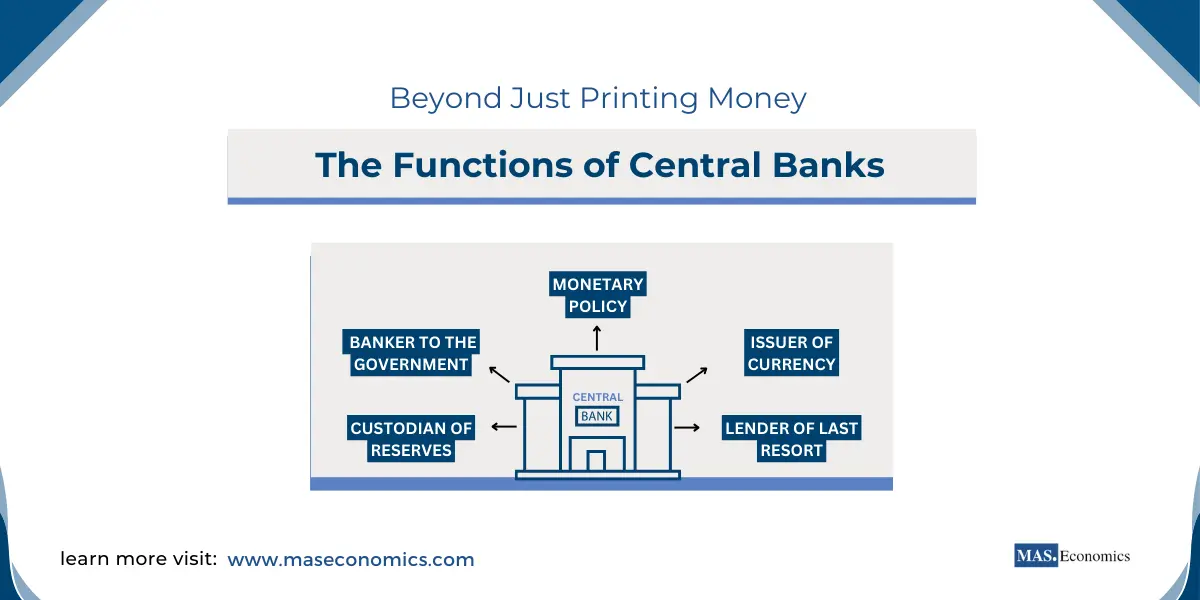

Central banks are sometimes seen as establishments that “print cash,” however the features of central banks go far past that. In actuality, central banks function guardians of monetary stability, enjoying essential roles in financial planning, financial coverage, and making certain a resilient banking system. The various features of central banks are important to the well being of contemporary economies, from managing inflation to appearing because the lender of final resort. Understanding these roles sheds mild on how central banks keep financial stability and foster development.

What Is a Central Financial institution?

A central financial institution is a public establishment chargeable for overseeing a rustic’s financial coverage, issuing forex, and sustaining the monetary stability of the economic system. In contrast to business banks, central banks are usually not profit-driven and are designed to serve the general public curiosity. A few of the most well-known central banks embody the Federal Reserve in the US, the European Central Financial institution (ECB), and the Financial institution of England.

The Core Capabilities of Central Banks

Central banks have a number of key features which are important to the financial well being of a nation. Let’s discover these roles in additional element:

Issuer of Forex

The Energy of Cash Creation

Some of the seen features of a central financial institution is its position because the issuer of forex. Central banks are chargeable for printing banknotes and minting cash that function the first medium of change throughout the economic system. This operate ensures there may be sufficient money circulating within the economic system to facilitate commerce and transactions.

Nevertheless, the issuance of forex is simply a small a part of cash creation. A lot of the cash in trendy economies is created by the lending actions of business banks, with central banks offering regulation to make sure stability.

Formulation and Implementation of Financial Coverage

Conserving Inflation in Examine

Central banks are tasked with formulating and implementing financial coverage to handle inflation and stabilize the economic system. Financial coverage includes regulating rates of interest and controlling the cash provide to attain financial targets, resembling steady costs and sustainable development.

Curiosity Fee Changes

By setting key rates of interest, central banks affect borrowing and spending within the economic system. As an illustration, reducing rates of interest makes borrowing cheaper, which stimulates financial exercise, whereas elevating rates of interest can assist quiet down an overheating economic system.

Open Market Operations (OMOs)

Central banks additionally conduct open market operations, shopping for or promoting authorities securities to manage liquidity within the monetary system. Via these measures, central banks can both encourage spending (expansionary coverage) or management inflation (contractionary coverage).

Banker and Advisor to the Authorities

Managing Public Debt and Advising on Coverage

Central banks function bankers to the federal government, managing the accounts of the central authorities and facilitating transactions. They play an important position in public debt administration, serving to the federal government elevate funds by the issuance of bonds and different securities.

Moreover, central banks usually function advisors to governments on financial coverage issues. Their experience in financial traits and monetary techniques makes them key gamers in shaping fiscal and financial insurance policies.

Custodian of Money Reserves and International Trade

Managing Reserves and Stabilizing the Forex

One other essential position of the central financial institution is because the custodian of the nation’s reserves, together with each money and international change reserves. Sustaining a reserve of foreign currency is important for stabilizing the change price and supporting worldwide commerce.

Central banks use their international reserves to intervene in international change markets, making certain that the nationwide forex stays steady in opposition to different currencies. That is notably necessary for international locations that rely closely on imports or exports, as forex fluctuations can have a big influence on commerce balances.

Lender of Final Resort

Guaranteeing Monetary Stability

Throughout occasions of financial uncertainty or monetary panic, central banks act because the lender of final resort. Which means they supply emergency funding to business banks which are going through liquidity points however are in any other case solvent. By doing so, central banks forestall financial institution runs and keep confidence within the banking system.

The lender of final resort operate grew to become notably related throughout the 2008 monetary disaster when central banks around the globe supplied liquidity to struggling banks to stabilize the monetary system. This position is essential for sustaining monetary stability and stopping systemic crises that would disrupt the economic system.

Supervisor of the Banking System

Guaranteeing Sound Banking Practices

Central banks are chargeable for supervising and regulating business banks and different monetary establishments. This includes making certain that banks keep sufficient capital reserves, comply with sound lending practices, and adjust to regulatory necessities.

Via their supervisory position, central banks purpose to reduce dangers throughout the banking sector and shield depositors. Efficient supervision helps forestall reckless banking practices that would result in monetary instability, as seen within the world monetary disaster.

Facilitator of Funds and Settlements

Clean Functioning of Cost Methods

Central banks additionally play a vital position in making certain the graceful operation of the fee and settlement techniques. They facilitate the switch of funds between business banks, making certain that transactions are processed securely and effectively.

A dependable fee system is important for financial exercise, because it underpins all monetary transactions, from retail funds to massive interbank transfers. Central banks keep the infrastructure wanted for these techniques to operate, together with the interbank settlement techniques.

Administration of Trade Controls

Managing Forex Flows

In some international locations, central banks are chargeable for the administration of change controls. Trade controls are measures used to control the move of international forex in and in a foreign country, which might be essential for sustaining forex stability and managing stability of funds points.

Trade controls can contain restrictions on forex change for sure kinds of transactions, resembling international funding or the import and export of products. These measures are sometimes carried out to guard international reserves or forestall capital flight.

Collector and Writer of Financial Knowledge

Offering Insights for Coverage and Determination-Making

Central banks are additionally chargeable for the gathering and publication of financial and monetary knowledge. This data is important for policymakers, traders, and analysts who want correct knowledge to make knowledgeable selections.

Publications like Quarterly Bulletins, Annual Studies, and month-to-month statistics on cash provide, rates of interest, and different key financial indicators are made obtainable by central banks. By offering this knowledge, central banks contribute to transparency and knowledgeable financial decision-making.

Public Debt Administration

Managing Authorities Borrowing

Central banks assist handle the federal government’s borrowing necessities by appearing as the first agent within the issuance of presidency securities. This includes managing the public sale of presidency bonds, setting rates of interest for these securities, and making certain a steady demand for presidency debt.

Efficient public debt administration is important to stop extreme borrowing prices for the federal government, which may result in fiscal imbalances. By sustaining investor confidence, central banks assist governments meet their funding wants in a sustainable method.

Why Are Central Banks Necessary?

Sustaining Financial Stability

The first objective of a central financial institution is to keep up financial stability. By controlling inflation, regulating the banking sector, and making certain a steady forex, central banks create an setting conducive to sustainable financial development. When central banks carry out their features successfully, they assist to cut back financial volatility, enabling companies and customers to make knowledgeable monetary selections with better confidence.

Supporting Employment and Development

By implementing applicable financial insurance policies, central banks can affect employment ranges and financial development. During times of financial downturn, central banks might decrease rates of interest to encourage borrowing and funding, thereby stimulating financial exercise and decreasing unemployment.

Conversely, when the economic system is rising too rapidly and inflation turns into a priority, central banks might tighten financial coverage to chill down financial exercise. This delicate balancing act helps to stop the boom-and-bust cycles that may result in monetary crises.

Challenges Confronted by Central Banks

Regardless of their necessary roles, central banks face quite a few challenges in fulfilling their mandates:

Balancing Inflation and Development

Central banks usually face the troublesome process of balancing inflation management with financial development. Tightening financial coverage to fight inflation can inadvertently sluggish financial development, resulting in trade-offs that should be rigorously managed.

Political Pressures

Central banks are designed to be impartial establishments, however they usually face political pressures to undertake insurance policies that favor short-term financial beneficial properties on the expense of long-term stability.

Navigating Unconventional Coverage Instruments

In occasions of maximum financial stress, resembling throughout the 2008 monetary disaster or the COVID-19 pandemic, central banks have resorted to unconventional coverage instruments like quantitative easing. Whereas these measures are efficient within the quick time period, they carry dangers, together with asset bubbles and elevated monetary inequality.

Conclusion

Central banks are way over cash printers; the features of central banks kind the spine of a steady monetary system. Their duties—from formulating financial coverage to appearing because the lender of final resort—are essential for sustaining financial stability and development. By managing inflation, regulating banks, and making certain the graceful operation of monetary markets, the features of central banks play an indispensable position in financial life, underscoring the advanced and infrequently behind-the-scenes work they do to maintain economies steady.

FAQs:

What’s the main position of a central financial institution?

Central banks are chargeable for overseeing financial coverage, issuing forex, and sustaining monetary stability. They purpose to manage inflation, assist financial development, and make sure the soundness of the banking system.

How do central banks affect inflation and financial development?

Central banks management inflation and stimulate financial development by financial coverage instruments like setting rates of interest and open market operations. Reducing charges can encourage borrowing and spending whereas elevating charges helps to curb inflation.

What’s the operate of a central financial institution because the “lender of final resort”?

Central banks act because the lender of final resort, offering emergency funding to business banks throughout monetary crises to stop financial institution runs and keep stability within the banking system.

Why do central banks handle international change reserves?

Central banks maintain international change reserves to stabilize the nationwide forex, assist worldwide commerce, and forestall extreme change price fluctuations.

How do central banks supervise the banking sector?

Central banks regulate business banks by making certain they keep sufficient capital, comply with prudent lending practices, and adjust to regulatory requirements. This supervision helps shield depositors and forestall monetary instability.

What position do central banks play in authorities debt administration?

Central banks help the federal government in managing its debt by issuing bonds, setting bond rates of interest, and making certain steady demand for presidency securities to keep up fiscal stability.

How do central banks influence fee techniques?

Central banks guarantee the graceful functioning of fee techniques by offering infrastructure for fund transfers between banks, which is essential for financial transactions.

What challenges do central banks face?

Central banks face challenges in balancing inflation management with development, managing political pressures, and navigating unconventional insurance policies like quantitative easing throughout financial crises.

Thanks for studying! Share this with associates and unfold the information should you discovered it useful.

Pleased studying with MASEconomics